ETH Price Prediction: Technical Strength and Fundamental Developments Signal Bullish Outlook

#ETH

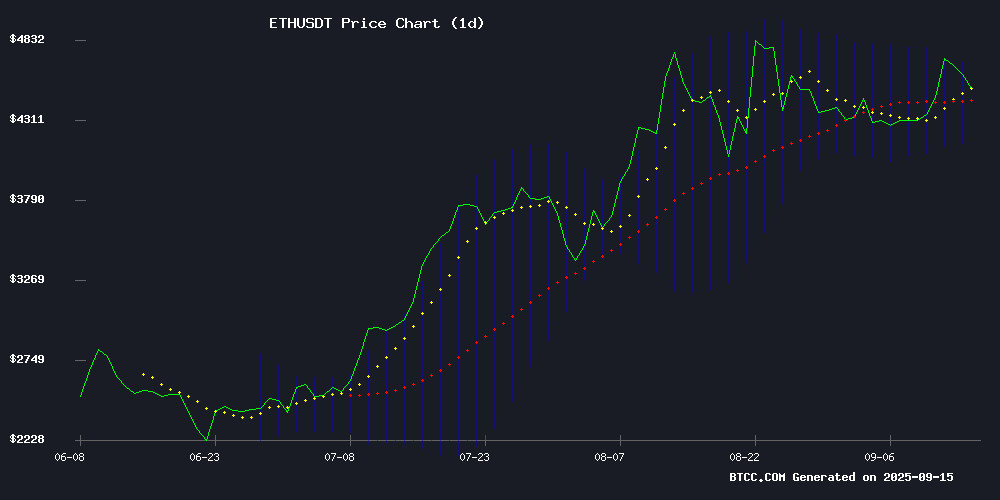

- ETH trading above 20-day MA indicates bullish technical momentum

- Significant ETH withdrawals from exchanges reduce circulating supply

- Growing institutional adoption through tokenized RWAs supports long-term value

ETH Price Prediction

Technical Analysis: ETH Shows Bullish Momentum Above Key Moving Average

ETH is currently trading at $4,529.55, positioned comfortably above its 20-day moving average of $4,417.84, indicating sustained bullish momentum. According to BTCC financial analyst Mia, 'The price trading above the moving average, combined with MACD showing positive divergence despite the negative histogram, suggests underlying strength. The Bollinger Bands configuration with price NEAR the upper band at $4,674.32 indicates potential for continued upward movement, though traders should watch for potential resistance at these levels.'

Market Sentiment: Network Activity and Privacy Focus Drive Positive Outlook

Recent developments surrounding ethereum are creating a fundamentally positive environment for price appreciation. BTCC financial analyst Mia notes, 'The unprecedented congestion in Ethereum staking networks and significant ETH withdrawals from exchanges—3.5 million ETH—demonstrate strong network utility and reduced selling pressure. Meanwhile, the Foundation's focus on privacy enhancements and the growing traction of tokenized real-world assets, potentially reaching $30 trillion, position ETH for substantial long-term growth despite current regulatory scrutiny.'

Factors Influencing ETH's Price

Ethereum Staking Network Faces Unprecedented Congestion as Queues Swell

Ethereum's staking mechanism is buckling under record demand, with both entry and exit queues now holding billions of dollars worth of ETH. ValidatorQueue data reveals 2.63 million ETH ($12.3 billion) awaiting withdrawal—a 45-day backlog—while 634,000 ETH ($2.97 billion) queue for validator activation, creating an 11-day delay.

The congestion follows Kiln's decision to wind down operations after the SwissBorg hack, flooding the exit queue with 1.6 million ETH in withdrawals. Market observers note this stress test exposes scaling challenges in Ethereum's proof-of-stake architecture as institutional participation grows.

Ethereum Cloud Mining Gains Traction Amid Market Volatility

Ethereum's price volatility has sparked renewed interest in cloud mining as investors seek stable returns. ETH has oscillated between $4,200 and $4,500 over the past fortnight, with weakened institutional demand fueling predictions of a drop toward $3,500. Traditional mining faces headwinds from rising hardware costs and regulatory scrutiny, pushing users toward cloud-based alternatives.

Platforms like Fleet Mining capitalize on this shift, offering AI-optimized contracts and multi-currency support. Their $15 sign-up bonuses and daily dividends appeal to risk-averse traders navigating choppy markets. The sector's growth underscores a broader trend of infrastructure democratization in crypto—though due diligence remains critical given varying transparency across providers.

Ethereum Foundation Unveils Privacy Stewards Initiative Amid Global Regulatory Scrutiny

The Ethereum Foundation has launched its Privacy Stewards initiative with a three-track roadmap to enhance transactional privacy on the network. This comes as global regulators, including the U.S. Treasury Department under Secretary Scott Bessent, push for identity checks on smart contracts—a move facing strong opposition from crypto advocates.

Private Writes aims to streamline confidential transactions through PlasmaFold, an experimental Layer 2 solution that offloads block proofs to servers while keeping balance proofs user-controlled. Private Reads addresses data leakage risks in RPC interactions, with a dedicated working group evaluating protective measures. Private Proving seeks to democratize zero-knowledge proof generation by enabling creation on consumer devices.

The initiative marks Ethereum's strategic response to growing surveillance pressures while advancing its core privacy capabilities. Development timelines remain undisclosed, but the foundation has established clear technical benchmarks for each privacy track.

Ethereum Developers Prioritize End-to-End Privacy in Blockchain Overhaul

Ethereum's development team has intensified efforts to embed comprehensive privacy features across its ecosystem, rebranding its privacy initiative as 'Privacy Stewards of Ethereum' (PSE). The move signals a strategic shift toward making privacy intrinsic to Ethereum's protocol, applications, and governance frameworks.

The PSE roadmap targets private transactions, data reads, and cryptographic proofs—addressing concerns that Ethereum's transparency could morph into a surveillance liability. 'Without robust privacy, Ethereum risks becoming a tool for global monitoring rather than financial sovereignty,' the team warned. Regulatory compliance remains a non-negotiable pillar of the initiative.

This upgrade could redefine adoption dynamics. Institutional players hesitant about public ledger exposure may reconsider Ethereum as private writes and proving mechanisms mature. The blockchain's core use cases—DeFi, identity management, and DAOs—stand to gain transactional confidentiality without sacrificing auditability.

Ethereum Withdrawals Surge as 3.5 Million ETH Leaves Exchanges

Nearly 3.5 million ETH has been pulled from cryptocurrency exchanges in recent weeks, marking one of the largest capital migrations in Ethereum's history. The exodus signals a fundamental shift in investor behavior—from speculative trading to long-term asset custody.

Exchange outflows of this magnitude typically precede bullish cycles. Investors appear to be positioning for Ethereum's upcoming network upgrades and potential supply shocks. The transition to proof-of-stake consensus through Ethereum 2.0 continues to reshape market dynamics.

Market analysts interpret the withdrawals as a vote of confidence in ETH's store-of-value proposition. With global macroeconomic uncertainty persisting, crypto assets are increasingly serving as digital hedges. Ethereum's fixed issuance schedule and deflationary mechanism further strengthen its investment thesis.

Ethereum Foundation Prioritizes Privacy with Ambitious Roadmap

The Ethereum ecosystem is undergoing a privacy revolution. The Ethereum Foundation has rebranded its Privacy & Scaling Explorations initiative as Privacy Stewards of Ethereum (PSE), signaling a shift from theoretical research to concrete implementation. The six-month roadmap includes PlasmaFold for private transfers, Kohaku wallet development, and confidential voting protocols—addressing what Vitalik Buterin calls "a fundamental right" in the face of increasing regulatory pressure.

This push comes as the US Treasury Department seeks to impose identity requirements in DeFi, sparking fierce opposition from crypto advocates. Ethereum's privacy-focused upgrades could redefine transactional anonymity while maintaining compliance with evolving global standards.

Tokenized RWAs Poised for $30T Growth as Polygon Labs Highlights Infrastructure Readiness

The tokenized real-world assets (RWAs) market is projected to explode from $300 billion in 2025 to $30 trillion by 2034, with stablecoins currently driving momentum. Ethereum alone recorded a $165 billion all-time high in stablecoin supply this week, underscoring the sector's rapid expansion.

Polygon Labs' Global Head of Payments Aishwary Gupta confirms blockchain infrastructure is evolving to meet demand. "Polygon recently upgraded to 1,000 TPS and will reach 5,000 TPS within months," Gupta notes, emphasizing the network's capacity to scale to 50,000 transactions per second if required.

While technical limitations recede, new challenges emerge in creating seamless systems for mass adoption. The industry continues to innovate as RWA tokenization transitions from niche experiment to mainstream financial infrastructure.

Is ETH a good investment?

Based on current technical indicators and fundamental developments, ETH presents a compelling investment opportunity. The price trading above key moving averages, combined with strong network activity and institutional adoption through tokenized assets, suggests continued upward potential.

| Indicator | Current Value | Signal |

|---|---|---|

| Current Price | $4,529.55 | Bullish |

| 20-day MA | $4,417.84 | Support Level |

| Bollinger Upper | $4,674.32 | Resistance Target |

| ETH Withdrawals | 3.5M ETH | Reduced Supply |

However, investors should monitor regulatory developments and be prepared for typical cryptocurrency volatility.